Spineway designs innovative technologies for spinal surgery

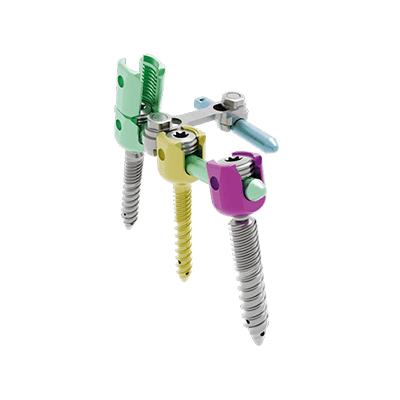

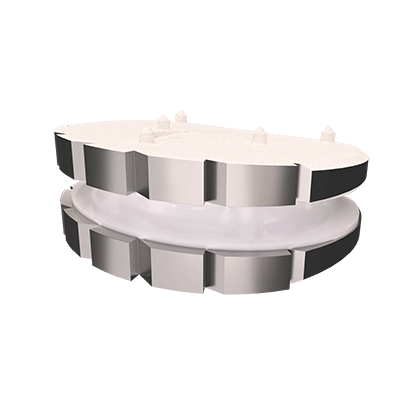

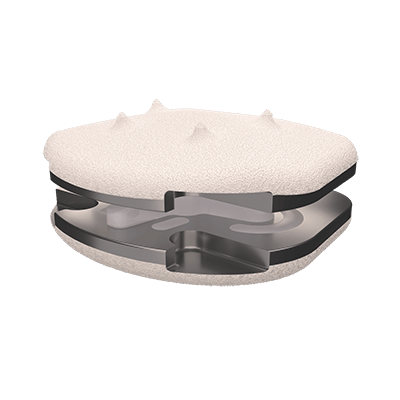

Spineway is an independent French company, founded in Lyon in 2005, specializing in the design and development of innovative technologies for spine surgery. By combining French expertise with an international network, we have seized major growth opportunities with the acquisitions of Distimp in 2021 and Spine Innovations in 2022. These integrations have enable us to broaden our offering by combining complementary product portfolios and territories, while proposing innovative solutions to treat new pathologies. Much more than just a manufacturer, we are committed to our surgeon partners. We offer a global program of customized training courses in surgical techniques, tailored to meet the specific needs of practitioners.